Id soluta ratione et sunt explicabo ut sapi ente molestiae quo laboriosam perspi ciatis et officia perspiciatis. Et internos distinctio eos.

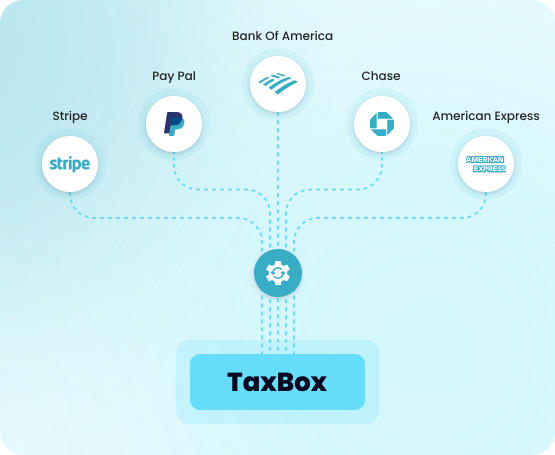

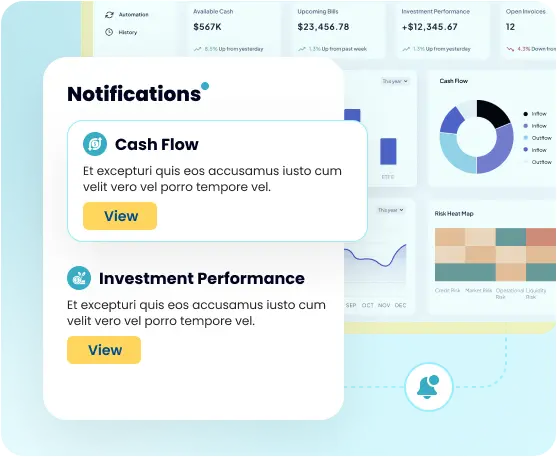

Navigating UAE Corporate Tax can be complex—but TaxBox makes it simple. Our experts handle your corporate tax calculations, compliance, and filings, ensuring you meet FTA regulations without stress. Whether you’re filing for the first time or need expert guidance, we’ve got you covered.

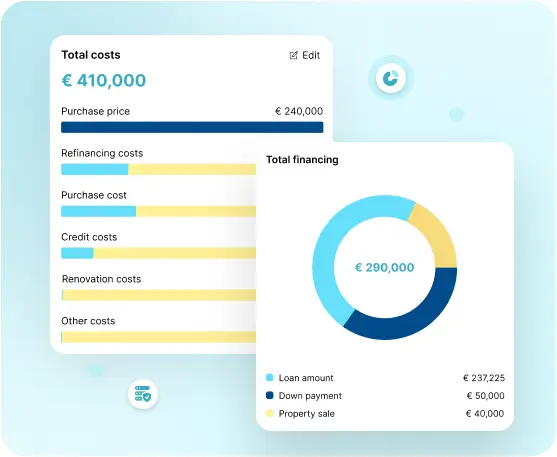

UAE’s new corporate tax laws require accurate record-keeping and timely filings. We handle everything—from tax calculations to submission—so you can focus on running your business.

Tax regulations can be overwhelming, but we simplify them for you. Our experienced tax professionals provide step-by-step assistance, ensuring you understand your obligations and maximize tax efficiency.

Incorrect filings or missed deadlines can result in hefty fines. We ensure your corporate tax is filed accurately and on time, so you stay compliant and avoid unnecessary penalties.

Corporate tax laws in the UAE are new and evolving. Keeping up with changes is essential to avoid compliance risks and optimize tax planning.

Accurate financial records are crucial for correct tax filing. With TaxBox, your corporate tax is backed by reliable financial reporting, VAT compliance, and audit readiness.

$25.00/Month

$50.00/Month

$25.00/Month

$59.00/Year

$80.00/Year

$32.00/Year

$25.00/Month

$50.00/Month

$59.00/Year

$80.00/Year

$50.00/Month

$80.00/Year

Id soluta ratione et sunt explicabo ut sapi ente molestiae quo laboriosam perspi ciatis et officia perspiciatis. Et internos distinctio eos.

Business Name

Id soluta ratione et sunt explicabo ut sapi ente molestiae quo laboriosam perspi ciatis et officia perspiciatis. Et internos distinctio eos.

Business Name

Their bookkeeping services are exceptional. We now have a clear financial overview, helping us make better decisions.

Business Name

Their bookkeeping services are exceptional. We now have a clear financial overview, helping us make better decisions.

Business Name

Id soluta ratione et sunt explicabo ut sapi ente molestiae quo laboriosam perspi ciatis et officia perspiciatis. Et internos distinctio eos.

Business Name

TaxBox transformed how we handle our finances. Their expert guidance saved us from VAT penalties. Highly recommend!

Business Name

Lorem ipsum dolor sit amet. Cum alias tenetur 33 consequuntur veniam aut quisquam voluptatem et voluptatem voluptas.